Bitget: Unleashing the Power of Cryptocurrency Investing with Fundamental Analysis and RSI

As cryptocurrency prices continue to fluctuate wildly, investors are looking for reliable ways to navigate this complex market environment. One such method is fundamental analysis, which involves analyzing a company’s financial statements, management team, industry trends, and competitive landscape to predict future performance.

At Bitget, a leading online cryptocurrency trading platform, fundamental analysis plays a critical role in identifying undervalued assets with high growth potential. Using advanced data analysis tools and proprietary market research, Bitget analysts provide actionable insights into the cryptocurrency market and help traders make informed decisions.

Bitget’s Approach to Fundamental Analysis

Bitget’s team of experienced analysts uses a variety of methods to analyze the cryptocurrency market. These are:

- Technical Analysis: This involves the use of charts and technical indicators to identify patterns and trends in price movements.

- Fundamental Analysis: As mentioned, this involves analyzing a company’s financial statements, management team, industry trends, and competitive environment to predict future performance.

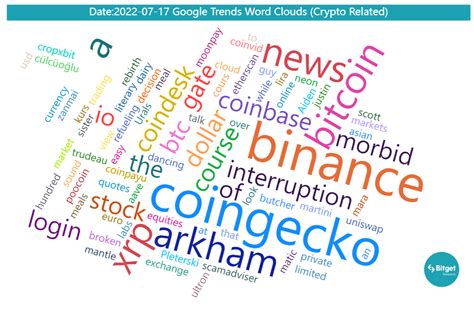

- Industry Trend Analysis: Bitget analysts study the latest market news and trends from a variety of industries, including technology, healthcare, and finance, to identify potential catalysts for cryptocurrency price movements.

Relative Strength Index (RSI)

Another powerful tool used by Bitget fundamental analysts is the Relative Strength Index (RSI). Developed in the 1970s by J. Welles Wilder, RSI measures the magnitude of recent price movements to identify overbought or oversold conditions.

By analyzing the RSI on a cryptocurrency chart, traders can identify potential buy and sell signals, as well as predict when prices are emerging from breakouts or consolidations. A value of 30 indicates an overbought condition, while a value between 20 and 70 is neutral, and below 20 indicates an overbought condition.

Key RSI Levels

When it comes to fundamental analysis, traders need to understand the key levels that correspond to specific market scenarios:

- Overbought: value above 80

- Overweight: value below 20

- Neutral: 30–69

Bullish: above 50

- Bearish: below 40

Conclusion

Bitget’s approach to fundamental analysis and RSI provides investors with an effective toolkit to navigate the cryptocurrency market. By combining technical and fundamental analysis, traders can identify undervalued assets with high growth potential and make informed decisions about when to buy or sell cryptocurrencies.

While no tool guarantees success in cryptocurrency investing, understanding fundamental analysis and RSI is an essential part of every trader’s toolkit. By monitoring market news and trends and using advanced analytical tools like Bitget, investors can make more informed decisions and potentially reap long-term benefits from their cryptocurrency investments.