The Role of AI in Cryptocurrency Data Analytics

The rise of cryptocurrencies has revolutionized the way we think about data and analytics. With the increasing complexity and scale of cryptocurrency transactions, companies are seeking innovative solutions to unlock insights from vast amounts of data. Artificial intelligence (AI) is playing a significant role in this process, enabling organizations to gain valuable business intelligence, optimize trading strategies, and improve overall performance.

The Challenges of Cryptocurrency Data Analytics

Cryptocurrencies present unique challenges for data analytics. The decentralized nature of these assets makes it difficult to gather reliable and consistent data from various sources, including exchanges, wallets, and marketplaces. Moreover, the constant volatility in cryptocurrency markets can make it challenging to predict price movements and trends.

To overcome these challenges, companies need a robust and scalable data analytics platform that can handle large amounts of complex data. Traditional data analysis tools often struggle to keep up with the pace of innovation in cryptocurrencies, leading to inadequate insights and decision-making.

The Role of AI in Cryptocurrency Data Analytics

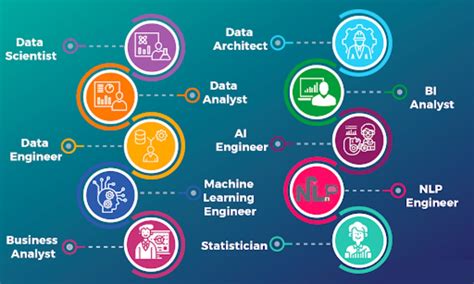

Artificial intelligence has emerged as a game-changer for cryptocurrency data analytics. By leveraging machine learning (ML) and deep learning algorithms, companies can develop predictive models that can analyze vast amounts of data from various sources, identifying patterns and trends that would be difficult to detect manually.

Some key roles of AI in cryptocurrency data analytics include:

- Predictive Modeling

: AI-powered predictive models can forecast market trends, identify potential price movements, and predict trading activity.

- Data Cleaning and Integration: AI-driven tools can automatically clean and integrate data from various sources, reducing the risk of errors and inconsistencies.

- Anomaly Detection: Machine learning algorithms can detect unusual patterns or anomalies in cryptocurrency data, alerting analysts to potential risks or opportunities.

- Automated Reporting: AI-powered reporting tools can generate insightful reports on cryptocurrency market trends, enabling businesses to make informed decisions.

Benefits of AI in Cryptocurrency Data Analytics

The benefits of using AI for cryptocurrency data analytics are numerous:

- Improved Accuracy: AI algorithms can analyze vast amounts of data more accurately and efficiently than traditional methods.

- Increased Scalability: AI-powered systems can handle large volumes of data, making them ideal for real-time analysis and prediction.

- Enhanced Insights: AI-driven insights enable organizations to gain a deeper understanding of cryptocurrency markets, helping them make informed decisions.

- Reduced Risk: AI-powered tools can detect potential risks or market inefficiencies, reducing the risk of financial losses.

Real-World Examples

Several companies are already leveraging AI for cryptocurrency data analytics, achieving impressive results:

- CoinDesk: The online publication has used AI to analyze cryptocurrency market trends and predict price movements.

- Bitwise: This investment research firm uses machine learning algorithms to generate predictive models of cryptocurrency markets.

- CryptoSlate: The cryptocurrency news platform has employed AI-powered tools for data analytics, providing insights on market trends and investor sentiment.

Conclusion

AI is revolutionizing the field of cryptocurrency data analytics, enabling organizations to gain valuable insights from vast amounts of complex data. By leveraging machine learning algorithms and other advanced techniques, companies can improve accuracy, scalability, and decision-making capabilities in cryptocurrency markets.